Portfolio Review Service

Do You Need a Second Opinion on Your Investment Portfolio?

Just like receiving a second opinion from a doctor, sometimes getting another well-informed perspective on an investment portfolio can deliver greater certainty and give you the confidence you need to act for your own benefit.

Our thorough, personal, and unbiased investment portfolio review will help you:

- See how your current asset allocation compares to an allocation based on your own time horizon, risk tolerance and investment objectives.

- Determine if your current holdings in stocks, bonds and/or mutual funds are meeting your investment goals.

- Plan a course of action, giving you advice on:

![]() Detailed Buy/Sell Recommendations that support your objectives

Detailed Buy/Sell Recommendations that support your objectives

![]() Asset Allocation strategy

Asset Allocation strategy

![]() Estimate Transaction Taxes and cost

Estimate Transaction Taxes and cost

![]() Risk tolerance

Risk tolerance

![]() 6 month “follow –up”

6 month “follow –up”

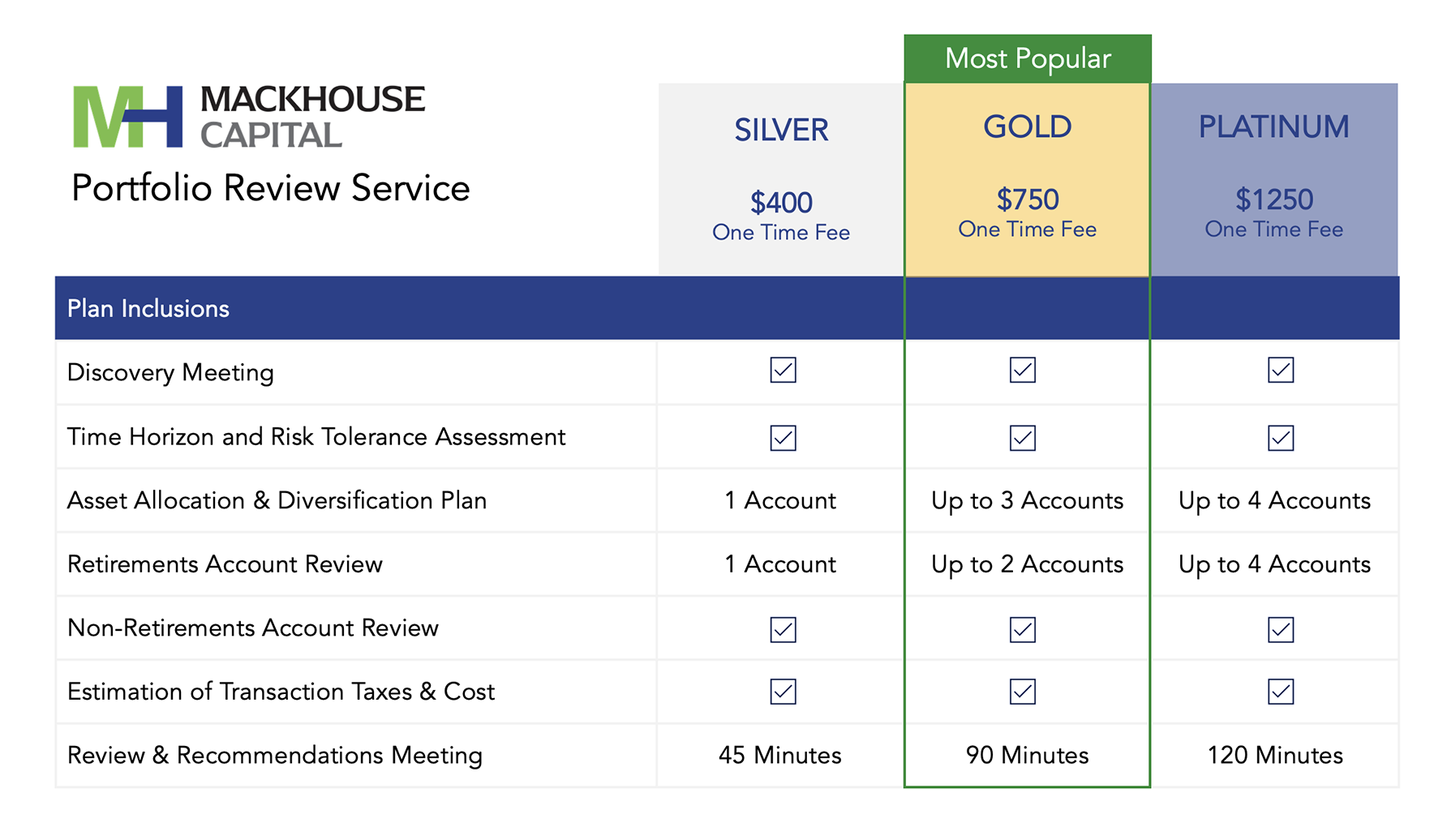

Our Level of portfolio review service

There are no ongoing fees. No monthly or annual subscription commitments. No assets under management (AUM) billing. No commissions. Just a single, transparent fee for easy-to-understand advice.

How Does this Process Work?

The Investment portfolio Review consists of three simple steps.

Step 1. Introductory Call

During this short call, I’ll review the three-step process for The Portfolio Review and answer any questions you may have. If we decide we should work together you send us or email us a copy of your investment portfolio (s) and we will schedule Step 2, the in person/phone consultation.

Step 2. In person or Phone Consultation

During our meeting/call, we will discuss where you are today, and where you want to be. We’ll review the areas of savings, tax planning, asset allocation, risk tolerance, investments, retirement distributions, and more.

Step 3. The Portfolio Review Write-Up Delivery – Five-Day Turn-Around

Within five days of our meeting, you will receive The Investment Portfolio Review write-up. This document outlines what you can do to improve your investment.